Health & other insurances in India are regulated by IRDAI – Insurance Regulatory & Development Authority of India, an autonomous body set up under the IRDA Act, 1999. The core idea behind setting up such a body was to protect the interests of policyholders and to regulate & develop the insurance industry. A lot has been done till date to protect and promote the interest of policyholders. But given the potential size of the industry and ever-changing dynamics, a lot has to be done on the regulatory front in the coming years as well.

Now before we move further to understand about top up insurance, let us look at health insurance in brief.

Health Insurance

Health emergencies do not come with prior notice. When such emergencies strike, it takes a toll on our pocket, thanks to the 5-star hospital facilities that charge a bomb.

Health insurance is coverage or hedge for an individual for medical expenses in case of a health emergency. There are some additional tax benefits too! But let’s focus on the broader aspect.

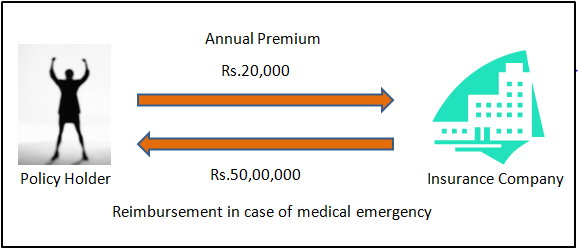

In simple words, you pay a fixed sum annually to the insurance company called as “Premium” and if you suffer from any health emergency the medical expenses/costs are borne by the insurance company, either by reimbursement of medical expenses or direct payment to the hospital (cashless facility).

Quick example: Ramesh, a 30-year-old working in an MNC pays Rs.20,000 annual premium as a personal expenditure for his health insurance cover of Rs.50 lacs.

This sounds good, but there is something more to it which we often ignore.

A lot of companies in India (as small as having only 100 employees) often provide a group health insurance policy wherein the employee is automatically covered up to a certain amount just by the virtue of being an employee of that company, which varies as per the seniority in the organization. But let’s understand with Ramesh’s example.

Given his age, Ramesh should have a group health policy of around Rs.5 lacs. Stay rest assured, due to all practical reasons, he must be unaware of the same. Even if he remembers, he might still end up buying Rs.50 lacs health insurance as indicated above! But is there a better option?

Top-Up Health Insurance

This is where a top-up policy comes into the picture. It is like a power bank, which will be used only when your phone’s battery is discharged. Just like a Stepney, which will be used when your car’s tyre is punctured!

Top-up plans are affordable, economical & most practical solutions for professionals and all others like Ramesh. In our example, Ramesh is already covered under his employer’s group policy up to Rs.5 lacs. Hence, he needs an insurance cover only if his medical expenses are beyond Rs. 5 lacs. This is known as a “Deductible”.

In simple words, if Ramesh gets admitted and his medical expenses are Rs.50 lacs, Rs.5 lacs would be reimbursed under his existing group policy. Therefore Ramesh would require additional coverage of only Rs.45 lacs! How can he do so?

Rather than opting for standard health insurance of Rs.50 lacs, he should go for top-up health insurance of Rs.50 lacs with Rs.5 lacs deductible.

This way the top-up insurance company will bear anything up to Rs.50 lacs excluding the first Rs.5 lacs which will be borne by the group policy.

This type of top-up policy will cost him only Rs.2,000 as an annual premium i.e. 90% lesser than what he was paying in case of standard health insurance! The older he gets, this premium amount keeps on increasing and the chance of issuance of a policy is relatively higher when we are young & naturally fit. Hence, it is advisable to enter an insurance policy at an early life stage to gain the maximum benefit!

You must be thinking about how something like this is even possible, but insurers are smarter than us! They know that their average reimbursements are never so high, but for us, it is a possibility, given the type of sedentary lifestyle any major disease can strike anytime. Hence, this is a win-win for both – the policyholder as well as the insurer.

Also know, it is not necessary to have a group policy for a top-up plan. If you are capable of managing the deductible portion i.e. Rs.5 lacs in our case, even then this policy is applicable to you. The Top-Up insurer is exempted till the first threshold being the deductible – whether you pay it from your pocket, group insurance, or from any other family floater policy. So why pay 10X premium for a health cover which can be affected at an economical cost with some basic planning? Think about it.

This optimal solution is available in the market but due to lack of awareness and lesser remuneration (due to lower premium amounts), this is not advertised & advised aggressively like other insurance products.

Note: I do not sell any kind of insurance products. Views are personal and do not reflect my employer’s views. This article is meant for public awareness and informational purpose only. Premium and cover amounts are approximated.